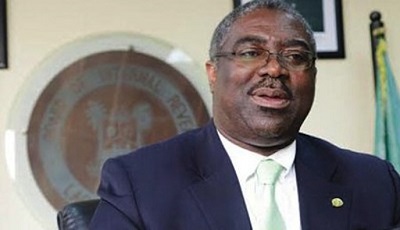

The executive chairman of the Federal Inland Revenue Service (FIRS), Babatunde Fowler says value-added tax (VAT) will be imposed on online transactions, both domestic and international, effective from January 2020.

Fowler said this on Monday during the African Tax Administration Forum (ATAF) technical workshop that held in Abuja.

According to Fowler, it was important for the country to tap into generating more revenue from online transactions, especially since it is a good venue for online businesses.

“We have thrown it out to Nigerians, effective from January 2020, we will ask banks to charge VAT on online transactions, both domestic and international,” Fowler said.

Read Also: IPOB Members Patiently Wait For Buhari In Japan (PHOTOS)

“VAT remains the cash cow in most African countries, with an average VAT-to-total tax revenue rate of 31%. This is higher than the Organisation for Economic Cooperation and Development’s average of 20%.

“This statistics, therefore, is a validation of the need for us to streamline the administration of this tax with the full knowledge of its potential contributions to national budgets.

“It is, however, also bearing in mind the rights of our taxpayers.”

Fowler says just like Senegal, Nigeria could do well in collecting VAT, adding that West African country generates 51% of its revenue from VAT while Nigeria generates 17%.